UTC:

Capital City:

Language:

Population:

Currency:

Country Code:

Domain:

+1

Luxembourg

Luxembourgish, French and German

672,050

Euro (EUR)

+352

.lu

Recent news

Israel – Luxembourg relations

Israel and Luxembourg established their diplomatic relations in May 1949, and since both countries have promoted a strong and positive cooperative partnership in different sectors. Over the years, the relationship between the countries has been further strengthened with high-level visits leading to the signing of several agreements, including a bilateral agreement on culture and a convention to avoid double taxation.

Furthermore, Luxembourg has established in Tel Avivi their Trade and Investment Office (LTIO), which aims to facilitate trade between Luxembourg and Israel and support Luxembourg-based businesses in entering and developing in the Israeli market. In 2022, Israel exported to Luxembourg goods and services worth $11.8 M, while Luxembourg’s exports to Israel in the same year reached $47.9 M.

Details about Israel’s embassy in Luxembourg

The Israeli Embassy in Brussels is responsible for managing diplomatic relations and providing consular services for both Belgium and Luxembourg.

Address: Av. de l’Observatoire 40, 1180 Uccle, Belgium

Phone: +32-02-3735500

Website: Click Here

Email: consular@brussels.mfa.gov.il

Details about Luxembourg Embassy in Israel

Currently, Luxembourg does not have a consular or diplomatic mission established in Israel. Instead, consular services are covered by the Luxembourg Embassy in Brussels, Belgium.

Address: 75, Avenue de Cortenbergh B-1000 Brussels, Belgium

Phone: (+32 -2) 737 57 00

Website: Click Here

E-mail: bruxelles.amb@mae.etat.lu

Business Activity in Luxembourg

Luxembourg, strategically located in Europe, houses a strong and competitive economy. As a founding member of the European Union and member of the Schengen Area, international trade and commerce are facilitated due to low customs duties and taxes. It is estimated that Luxembourg exports around 65% of its products and services, and is well-known for its competency in services, especially those in the financial sector. For instance, in 2018, Luxembourg had a 2.8-billion-euro surplus in the services account.

In addition, other main exports include metal products, machinery, and transportation materials. Luxembourg’s main trade partners include Belgium, France, and Germany, and thanks to the Silk Road Project, the commerce relations have expanded to the Middle East, Asia, and even the United States.

Luxembourg’s primary sectors vary between finance and green finance, information technologies, aerospace, and the automotive industry. Also, the country’s circular economy and its focus on health technologies make it a leader in sustainability.

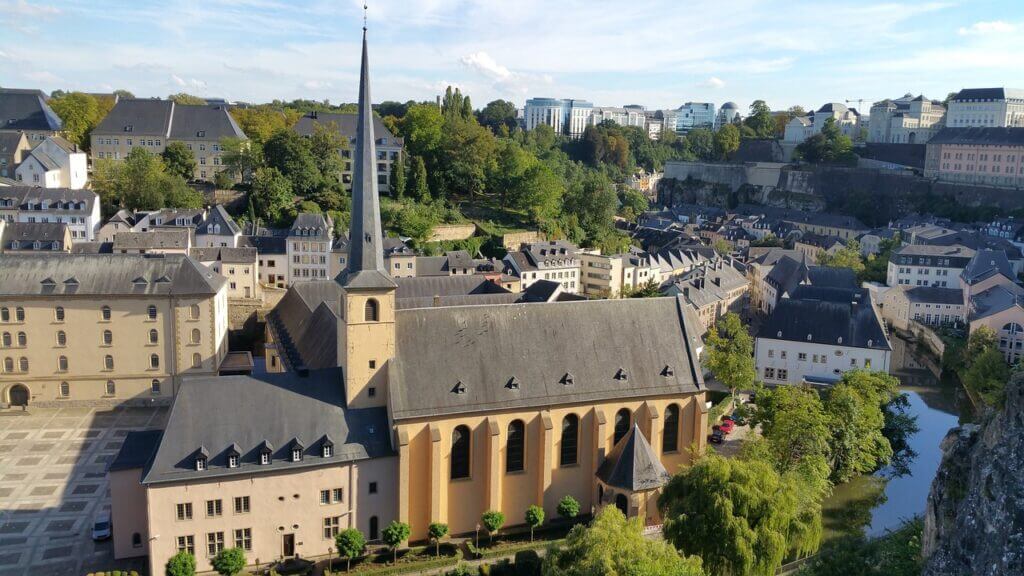

Tourism is also flourishing in Luxembourg due to its excellent location and good relations with neighboring countries. Luxembourg’s international and multilingual population creates a beautiful cultural mix and facilitates business work and commercial ties.

Bilateral Agreements Between Luxembourg and Israel

The following agreement was signed between Israel and Luxembourg

- Double Taxation Agreement

Convention on the Prevention of Double Taxation

The agreement between the Governments of Israel and Luxembourg regarding the avoidance of double taxation was signed on 12 December 2004 and entered into force on 31 December 2003.

To read the agreement in English click here.

Applicability of the MLI

Israel has signed the “Multilateral Convention to Implement Tax Treaty-Related Measures to Prevent Base Erosion and Profit Shifting” (MLI). Israel signed the agreement on June 7, 2017, and ratified it on September 13, 2018. Luxembourg signed the agreement on June 7, 2017, and ratified it on April 9, 2019.

Residency for Tax Purposes in Luxembourg

Residence of an Individual

An individual is considered a tax resident in Luxembourg if they have a permanent or fixed residence in Luxembourg, or if they spend more than six consecutive months even if the period overlaps two fiscal years or is interrupted by short absences.

To read about how an individual is considered a resident of Israel, click here.

Residency of a Company

A company is considered a tax resident if its registered office or its main administration – that includes board meetings, shareholder meetings, record-keeping, and anything related to management and operational activities, is located in Luxembourg.

To learn about how a company is considered a resident of Israel, click here.

The Tax System in Luxembourg

Luxembourg’s Tax Authority is called Luxembourg Inland Revenue (ACD).

Income Taxation:0% – 42%

Taxation of Companies and Branches:15%, 17% (16% in 2025), 31% + EUR 26,250

VAT: 3%, 8%, 14%, 17%

Capital Gains Tax: 0% to 45.78%

Withholding Tax

| Luxembourg Internal Tax Rate | Israel Internal Tax Rate | Treaty Withholding Tax | |

| Personal Income Tax (Tax brackets in EUR) | 0 to 12,438 – 0% 12,438 to 14,508 – 8% 14,508 to 16,578 – 9% 16,578 to 18,648 – 10% 18,648 to 20,718 – 11% 20,718 to 22,788 – 12% 22,788 to 24,939 – 14% 24,939 to 27,090 – 16% 27,090 to 29,241 – 18% 29,241 to 31,392 – 20% 31,392 to 33,543 – 22% 33,543 to 35,694 – 24% 35,694 to 37,845 – 26% 37,845 to 39,996 – 28% 39,996 to 42,147 – 30% 42,147 to 44,298 – 32% 44,298 to 46,449 – 34% 46,449 to 48,600 – 36% 48,600 to 50,751 – 38% 50,751 to 110,403 – 39% 110,403 to 165,600 – 40% 165,600 to 220,788 – 41% More than 220,788 – 42% | Up to 50%

| |

| Corporate Income Tax | 15%, 17% (16% in 2025), 31% + EUR 26,250 | 23% | |

| Capital Gains Tax Rate | 0% to 45.78%

| 25%-30% (plus exceptional income tax for high earners at 3%) | |

| Branch Tax | 15%, 17% (16% in 2025), 31% + EUR 26,250 | 23% | |

Withholding Tax (Non-Resident) Dividends | 15% |

25% or 30%

|

15% |

Interest

| 0% | 15%/25%/23% | 0% |

| Royalties | 0% | 23%-40% | 0% |

| VAT | 3%, 8%, 14%, 17% | 18% |

Inheritance and Estate Tax in Luxembourg

Inheritance tax in Luxembourg is set differently for each resident based on the inheritance share, the inherited assets’ value, and the relation with the person who left the inheritance. This tax is applied only to assets within the country. Non-residents are not taxed, but they have to pay a death duty.

Relocation to Luxembourg

For any individual or business looking to relocate to Luxembourg, there are numerous reasons why it is a great idea. Firstly, Luxembourg is a gateway to Europe with access to a market of 445 million consumers. The country has the best business-friendly policies ranking 1st place on simple business creation and openness.

Moreover, Luxembourg has a stable economy and is known for its political stability. The country is well known for leading the service industry, with finance, ICT, cleantech, health technologies, and maritime being some of the main business sectors in the country.

It is one of the safest countries for foreigners to live in ranking in 4th place, and 1st place as the most welcoming and international nation. Luxembourg’s healthcare system is one of the best in the world, as well.

The Jewish Community in Luxembourg is represented by the Consistoire Israélite de Luxembourg, which is a member of the Jewish World Congress.

Real Estate Taxation in Luxembourg

In Luxembourg, property taxes are determined by municipalities using the following formula: Tax base x communal rate.

The tax base can range from 0.7% and 1%, while the communal rate ranges from 200% to 400% depending on the property’s type and location.

Transfer of Funds from Israel to Luxembourg

According to section 170(a) of the Israeli Income Tax Ordinance, all payments transferred to non-Israeli residents are subject to a 25% withholding tax. However, this tax can be reduced or even waived if certain conditions are met. The tax authority can allow, under certain circumstances, to reduce or dismiss the withholding tax. Our firm handles withholding tax matters with the Israeli Tax Authority.

As mentioned above, the countries have signed a tax treaty, that allows taxpayers to submit 2513/2 form – Statement regarding a payment to a foreign resident that is exempt from withholding tax, to potentially transfer the payments without paying the withholding tax.

In addition to assisting with withholding tax matters, our firm also helps with other issues related to transferring funds abroad. This includes providing an accountant’s approval regarding the payment of taxes, reviewing additional actions required under the CRS standard, and more.

Moreover, banks often raise many difficulties and charge high fees for converting shekels into other currencies. Therefore, consulting with a specialist before transferring the funds is highly recommended, click here to contact us.

For more information on money transfers abroad, click here.

Types of Business Entities in Luxembourg

The main types of legal entities operating in Luxembourg include:

- Sole Proprietorship –These entities are differently regarded as self-employed individuals. Its establishment and administrative procedures are easy, there is no minimum capital needed, and the business duration is flexible.

- Partnerships (SENC) – In Luxembourg, partnerships are commercial entities in which partners are jointly and fully responsible for the company’s assets and obligations. This type of business is most suitable for small and medium-sized family firms due to its simple, low-cost establishment, and no minimum initial capital.

- Private Limited Liability Company (SARL) – Private limited companies are the most preferred business type in Luxembourg since two-thirds of companies are SARL. This entity can have 2 to 100 shareholders and there is an initial EUR 12,000 investment capital required for each shareholder however, the company can be managed by a single manager that can be either foreign or from Luxembourg. The company should be established in the presence of a notary.

- Public Limited Company (SA) – In Luxembourg, public limited companies are best suited for large companies but also small and medium-sized enterprises. Shareholders’ responsibility is equal to their contributions which initially should be EUR 30,000. Shares can be transferred. This entity requires at least one partner, and it is set up in the presence of a notary.

- Foundations and Non-Profit Associations (ASBL) – In Luxembourg, foundations are non-profit organizations focused on philanthropic and social activities. To establish one, approval is needed from a Grand Ducal decree, along with an application that includes a will or a detailed three-year plan explaining the foundation’s purpose. A Board of Directors, with at least three members, manages the foundation, which is liable for any mistakes made by its administrators. Donations can only come from known sources, and any donations over EUR 30,000 must be approved by the Minister of Justice.

Incentive Laws in Luxembourg

Aiming to stimulate investment and innovation, Luxembourg offers a variety of tax incentives. There are incentive laws for activities in risk capital, the audiovisual industry, environmental preservation and protection, research and development, professional training, and the hiring of unemployed citizens.

One of the main tax incentives is the investment tax credit that lowers businesses’ tax for qualifying investments based on certain criteria like durability, location, type of business, and application form. Also, businesses can receive an 80% tax exemption on intellectual property assets.

Luxembourg provides financial aid to research and development (R&D) activities in the form of innovation loans, cash grants, and interest reduction. Depending on the type and size of the research, companies can get up to 100% financial support. In addition, the country offers tax deductions on green initiatives and new tangible assets.

Double Tax Treaties in Luxembourg

| Turkey | Senegal | Mauritius | Isle of Man | Czech Republic | Andorra |

| Ukraine | Serbia | Mexico | Israel | Denmark | Argentina |

| United Arab Emirates | Seychelles | Moldova | Italy | Estonia | Armenia |

| United Kingdom | Singapore | Monaco | Japan | Finland | Austria |

| United States | Slovakia | Morocco | Jersey | France | Azerbaijan |

| Uruguay | Slovenia | Netherlands | Kazakhstan | Georgia | Bahrain |

| Uzbekistan | South Africa | Norway | South Korea | Germany | Barbados |

| Vietnam | Spain | Panama | Kosovo | Ghana | Belgium |

| Sri Lanka | Poland | Kuwait | Greece | Botswana | |

| Sweden | Portugal | Laos | Guernsey | Brazil | |

| Switzerland | Qatar | Latvia | Hong Kong | Brunei | |

| Taiwan | Romania | Liechtenstein | Hungary | Bulgaria | |

| Tajikistan | Russia | Lithuania | Iceland | Canada | |

| Thailand | Rwanda | Macedonia | India | China | |

| Trinidad and Tobago | San Marino | Malaysia | Indonesia | Croatia | |

| Tunisia | Saudi Arabia | Malta | Ireland | Cyprus |