We Are In The Media

NY » We Are In The Media

Ynet - Tax planning |

14.04.24

"He requested tax planning that would impact his ex-wife's portion of the pension – and it was rejected."

In the article, Nimrod Yaron, a former senior accountant at the tax authority, specified that the judge adopted the expert’s conclusion and determined that military pensions will be considered as “primary” income.

Globes – Valuation Discussions | 02.04.24

The new method of the Tax Authority to catch renters who do not report income

An interview of Nimrod Yaron, details the Tax Authority’s plans for a voluntary disclosure procedure. The Tax Authority has begun an operation to collect and cross-check information on tens of thousands of property owners in Israel, after for years apartment renters who falsified their income remained under the radar.

Mako – Valuation Discussions | 13.03.24

In an insightful discussion, Nimrod Yaron, a former high-ranking official with the Tax Authority, sheds light on specifies that an owner of a company who concealed hundreds of thousands of shekels managed to avoid actual imprisonment.

Ynet – Valuation Discussions | 12.02.24

Minimizing Fines and Penalties with Voluntary Disclosure Programs

Recently, a verdict was delivered by the Haifa Magistrate’s Court in a case involving an indictment against a captain for failing to report income totaling NIS 824,489, which would result in a tax liability of NIS 140,163. Our firm accompanies voluntary disclosure processes, through which undeclared funds can be settled with the tax authorities. This process aims to prevent criminal charges and minimize penalties. The Tax Authority plans to introduce a new voluntary disclosure program in the coming period, reinstating a previously temporary measure. In the captain’s case, the judge considered mitigating factors, such as the captain’s displacement from his home twice during the war. However, such mitigating circumstances may not always be available to taxpayers, underscoring the importance of engaging with experts familiar with these intricate processes.

Ynet – Valuation Discussions | 31.01.24

In an insightful discussion, Nimrod Yaron, a former high-ranking official with the Tax Authority, sheds light on a contentious issue involving the Authority’s representatives. These officials endeavored to persuade the court that advanced machinery should not be classified as ‘forklifts’, contrary to the importer’s assertions, thus making them liable for customs duties. Contrary to the Tax Authority’s stance, the judge held a divergent view, recognizing the equipment as ‘forklifts’ and thereby exempting them from customs charges.

Albania news site "Faktor" - International Taxation | 27.01.24

CPA Nimrod Yaron tells "Faktor" about: Albania and Israel relations – warming of relations between the countries

Albania and Israel have always had a special historical connection. The Jews in Israel will forever remember Albania as the only country that was under the rule of the Axis countries, where the number of Jews increased from the number before the Holocaust.

The deep historical connection between the nations and the pleasant feeling received by Israeli businessmen in Albania, in my opinion, will deepen the cooperation between the countries.

Read the article on the Albanian “Faktor” website by clicking here

Ynet - Voluntary Disclosure of Crypto | 04.01.24

Tax Procedure on Crypto Profits: Who Does It Really Benefit?

Nimrod Yaron, CPA, a former senior official at the Tax Authority, discusses a procedure published this week by the Tax Authority. The procedure is titled “Temporary Order for the Collection of Taxes on Profits from the Realization of Distributed Payment Means.

"Relevant" Network - Tax Planning | 29.11.23

An interview with Nimrod Yaron discussing the advantages available to new immigrants and returning residents who are coming to Israel due to the increasing anti-Semitism worldwide.

A newspaper in the Czech Republic - International Taxation | 27.11.23

Nimrod Yaron was interviewed for the Czech newspaper "Today" - The war also affects the economic preferences of Israelis

In the interview, Nimrod explained that Israelis currently prefer to do business with countries that support Israel, and the rising anti-Semitism in Europe is causing many Jewish people to consider immigrating to Israel, thereby increasing the demand for real estate in Israel.

Additionally, due to the uncertainty of the period, many Israelis want to open bank accounts in other countries and choose to do so only in countries that support Israel – therefore, the Czech Republic is an excellent candidate for this purpose.

Ynet - International Taxation | 20.10.23

Due to the ongoing conflict in Israel, remote workers have the opportunity to minimize their tax expenditures.

CPA Nimrod Yaron, a former senior official at the tax authority, discusses the reduction of tax expenses due to the war in Israel and what should be done when working remotely abroad. In many cases, it is possible to claim expenses and deduct them from the taxable income in the home country.

MAKO - International Taxation | 19.10.23

Staying outside of Israel due to the situation? The tax can be reduced

CPA Nimrod Yaron, a former senior official at the tax authority, discusses the reduction of tax expenses due to the war in Israel and what should be done when working remotely abroad.

Ynet - Inheritance Real Estate Tax | 05.09.23

Judge: Transferring property between siblings is subject to capital gains tax

CPA Nimrod Yaron, a former senior official at the Tax Authority, recounts a case involving a brother and sister who managed an estate near Nahariya, which they inherited and later disputed. Eventually, it was determined that the brother would receive the estate with compensation to his sister. The court ruled that this was a tax event.

Ynet - Voluntary disclosure prevents punishment | 31.05.23

3 years of imprisonment for the 'accomplice' who embezzled millions and evaded taxes

CPA Nimrod Yaron, a former senior official at the Tax Authority, reveals a new court ruling that has been published and could have been avoided through a series of proceedings against the Tax Authority.

Ynet - Real estate rental taxation | 05.04.23

He removed income, and thanks to the prosecutor's office he did not go to prison

CPA Nimrod Yaron, a former senior official at the Tax Authority, tells of a defendant who falsified rental contracts in order to reduce taxes on an amount of about half a million shekels.

Galei Zahal - Transfer of funds from Israel to abroad | 12.02.23

'Life itself' - Gali-Zahal leading economic plan

Nimrod was interviewed for the program ‘Life itself’ – the leading financial program of Gali-Zahal, regarding the transfer of funds from Israel abroad.

The Marker - High-tech companies that are considering the possibility of moving part of their operations abroad | 29.01.23

An entrepreneur looks a year or two ahead, and the risk is the threat to the Israel brand

CPA Nimrod Yaron in an interview with Ofir Dor, De Marker wrote, on the subject of high-tech companies that are exploring the possibility of moving part of their operations abroad, following the government’s measures for a regime change: “We are currently assisting dozens of companies and individuals in the process of building a tax structure for moving abroad.”

A newspaper in the Czech Republic - the new government in Israel | 29.01.23

The new government in Israel and effects on the Israeli economy

Nimrod was interviewed again by the leading Czech newspaper idnes, for an article about the new government in Israel and its effects on the Israeli economy.

Mako - Real Estate Taxation | 17.01.23

30 transactions in 25 years: a meat merchant will also pay VAT on real estate transactions

An article about a businessman in the meat sector who appealed his VAT charge on real estate transactions in two real estate properties. The Supreme Court ruled in a majority opinion that the man must pay VAT in the amount of about one million shekels

Ynet - Real Estate Taxation | 17.01.23

A developer claimed that he purchased apartments as a private individual. A judge thought otherwise

An article about a real estate man claimed that 3 apartments in his commercial projects are not taxable as business income, since they were purchased for his private needs. The court ruled that not enough evidence was presented

News 13 - Taxation of prizes and lotteries | 03.12.22

Won the lottery for NIS 45 million - and appealed the charge with a miracle

An article about a resident of Gaza, claimed that as a foreign resident he does not have to pay income tax in Israel. The court ruled that the claim is contrary to the purpose of the legislation that imposes a tax on lottery winnings

A newspaper in Albania - Israel Business | 07.11.22

Establishment of the Israel-Albania Chamber of Commerce, Ambassador Kanji meets Nimrod Yaron

Israeli investments in Albania are increasing. Israel and Albania signed the agreement to prevent double taxation in 2020.

A newspaper in the Czech Republic - Israel as a safe investment port | 07.10.22

An article about Israel as a safe investment port in which CPA Nimrod Yaron was interviewed for a newspaper in the Czech Republic

The article presents Israel as a safe investment port compared to other countries because of its good handling and extensive experience with inflation. The author refers to Israel’s cyber capabilities and the high-tech and electricity sector in particular and asks for Nimrod Yaron’s position regarding the areas recommended for investment in Israel.

Ynet - Economy and consumerism | 07.08.22

CPA Nimrod Yaron, a former senior member of the Tax Authority, represents a lawyer who made a mistake and was charged 400,000 NIS, winning his insurance

The Magistrate’s Court in Petah Tikva recently accepted a lawsuit filed by a lawyer who made a mistake in the advice given by his clients, against the Migdal company that insured him with professional liability insurance. At first the company refused to pay him, but judge Amir Lokshinsky-Gal rejected its claims and criticized its conduct.

News 13 - the main edition | 26.1.22

CPA Nimrod Yaron, a former senior official at the Tax Authority, was interviewed for the investigation into the tax offenses allegedly committed by Moshe Hogg

CPA Nimrod Yaron participated in an article by Baruch Kara and Tal Shurer that was broadcast on Wednesday 1/27/22 on the main edition of Channel 13 on the subject of tax offenses that Moshe Hogg allegedly committed and are now being investigated by the Tax Authority. Nimrod explained the taxation aspect and the Tax Authority’s position on this type of crime. Watch the full article:

New York Times newspaper | 6.1.22

CPA Nimrod Yaron was interviewed for an article in the New York Times about real estate in Israel

The “New York Times” newspaper published a comprehensive article on the Israeli real estate market. As part of the article, Michael Kaminer, the New York Times reporter, interviewed CPA Nimrod Yaron on real estate taxation in Israel. The article was published in the printed newspaper and on the newspaper’s website. To read the full article in the “New York Times”:

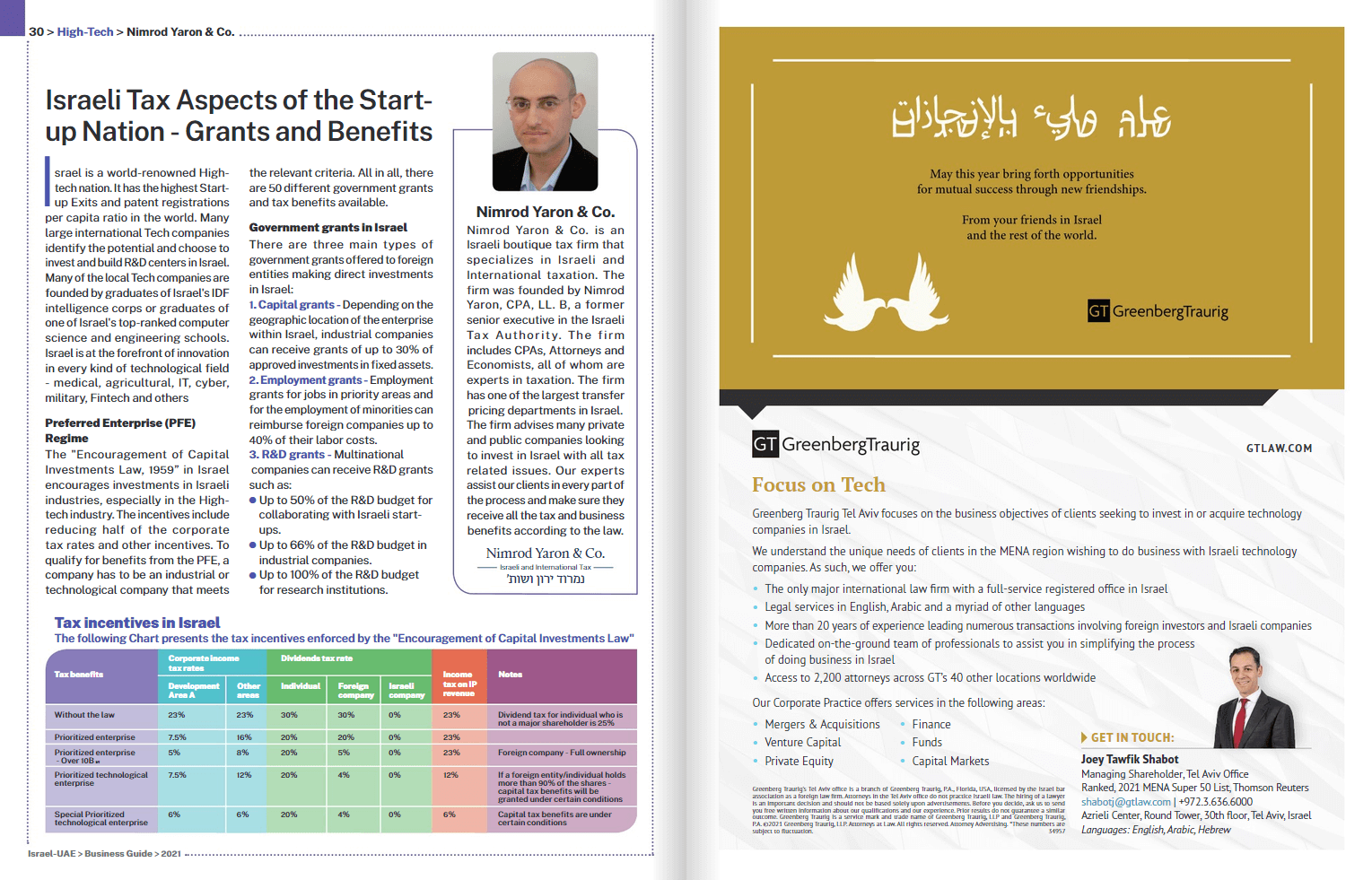

Israel UAE Business Guide | 2021

A business guide that was published in collaboration Israeli and Emirati companies, with the support of the Ministry of Foreign Affairs, the Export Institute and the Association of Manufacturers

The office of Nimrod Yaron & Co., took part in a business guide that was recently published by an Israeli company and an Emirati company, with the support of the Ministry of Foreign Affairs, the Export Institute, the Association of Manufacturers and other Emirati companies. The purpose of the guide is to assist cooperation between Israel and the United Emirates. In the guide, our office reviewed the The tax benefits that exist in Israel by virtue of the Capital Investments Encouragement Law. Link to the business guide:

A newspaper in Albania - Israel Today | 29.09.20

Guidance of procedures for Israeli investors, meeting of Ambassador Kanaj with Nimrod Yaron

The Ambassador of Albania to Israel, Dr. Bardhil Kanaj held a meeting with Nimrod Yaron, head of the Israeli company “Nimrod Yaron & Co. Israeli and international taxation”, during which we will discuss the ways of cooperation, to facilitate tax procedures for businesses and investors who wish to enter the Israeli and Albanian market.