Receiving inheritance from abroad raises complex questions regarding taxation and banking for Israelis. Understanding the inheritance tax in Israel and the tax implications of foreign inheritance is crucial for anyone expecting to receive assets from overseas.

Is There Inheritance Tax in Israel?

Between 1949 -1981, Israel had an estate tax ranging from 40% to 70%, but since 1981, the estate tax has been abolished, and currently, there is no inheritance/estate tax in Israel.

Despite the formal absence of inheritance tax in Israel, in certain cases, the Tax Authority may impose tax on the full value of the received inheritance, such as capital gains tax when selling the asset, if a proper and legal tax ruling procedure is not conducted with the Tax Authority. Conducting such a procedure can prevent taxation on the total value of the inheritance and instead impose tax only on the profit, for example, from selling the inherited asset.

In recent years, there have been increasing calls to introduce an inheritance tax into the Israeli tax system, partly due to criticisms that inheritances create inequality and are not part of the free market mechanism. Supporters of reintroducing the inheritance/estate tax believe it is a tool to reduce societal gaps and increase state revenue in accordance with international standards.

Inheritance Tax versus Estate Tax – What’s the Difference?

There is a procedural difference between the estate tax and the inheritance tax. Inheritance tax applies to the heir after the inheritance has reached them, while estate tax applies to the estate assets before they reach the heir. Taxation under the inheritance tax varies for each heir according to their relationship to the deceased. Generally, the closer the relationship between the deceased and the heir, the less tax the taxpayer (heir) will pay.

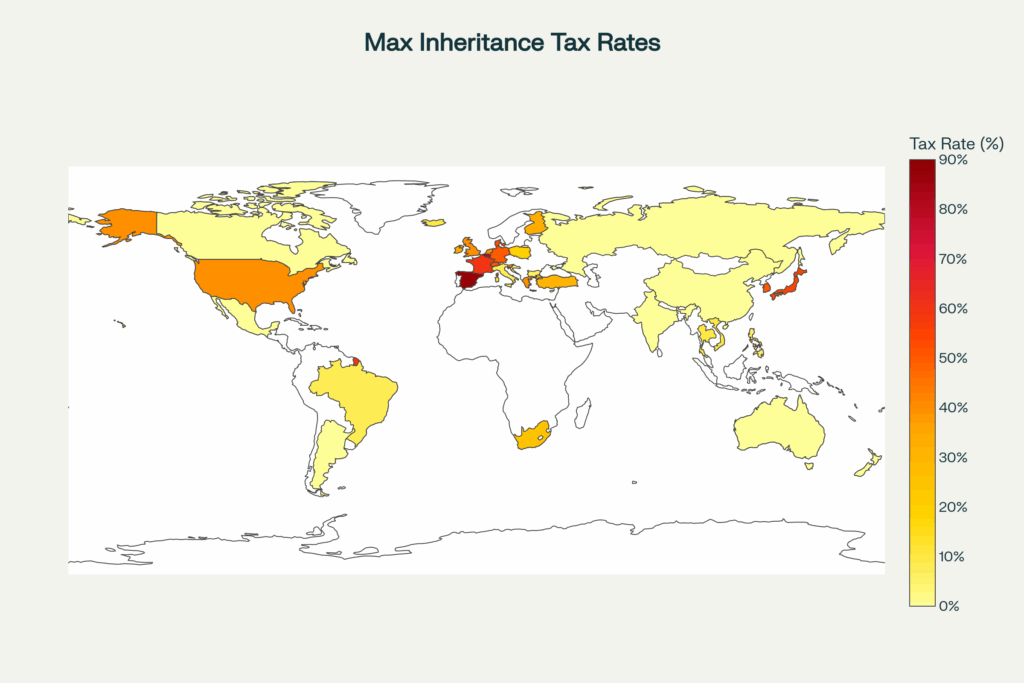

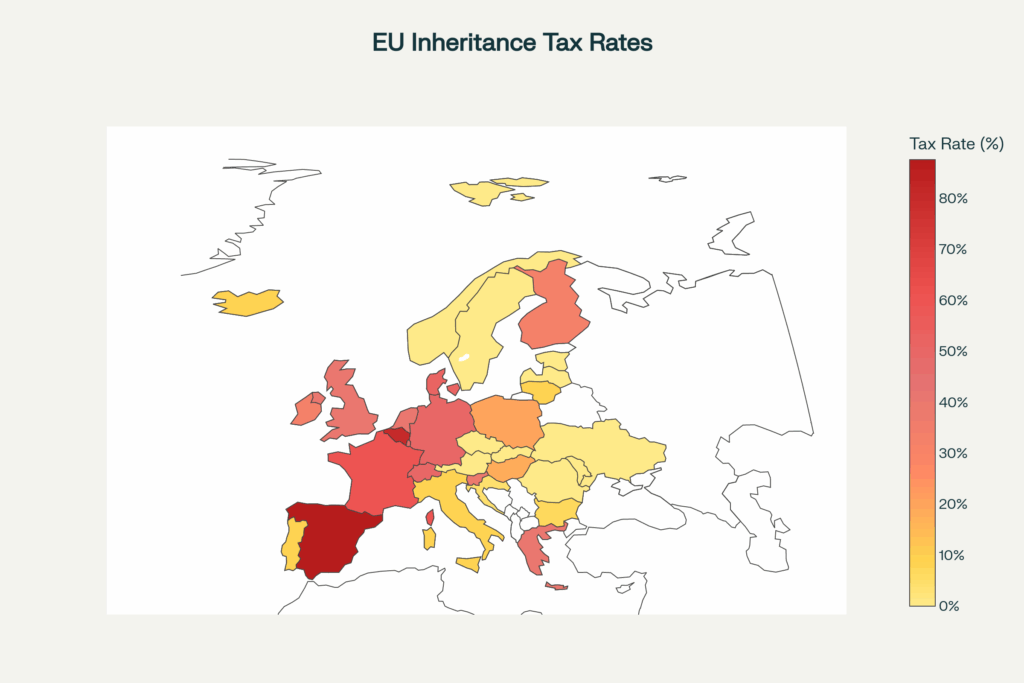

Estate Tax and Inheritance Tax – Global Comparison

Around the world, there are countries that have adopted estate and inheritance taxation as part of their tax model. Among them is the UK, where an estate tax of up to 40% is imposed (under certain conditions, there is an exemption from the estate tax).

In the United States, the estate tax applies at a rate of up to 40% above certain exemptions (according to citizenship status). In Germany, there is no estate tax, but inheritance tax depends on the family relationship between the deceased and the heir and the amount of inheritance; the tax rate for a spouse, parent, or descendant ranges from 7% to 30%, and in the absence of family relationship, the tax rate will be between 30%–50%. At the bottom of the list of countries imposing inheritance tax are, for example, Italy with an inheritance tax between 4 to 8% and Croatia with an inheritance tax of 4%, while countries that do not impose inheritance tax include Sweden, Norway, Romania, Cyprus, and others.

Another aspect related to inheritance taxation is the forced inheritance policy that exists in certain countries. According to certain inheritance laws/arrangements, there are restrictions on how the estate is distributed and even requirements to transfer the inheritance to relatives. For example, according to Spanish inheritance law, if the deceased was married at the time of death, 50% of the inheritance will go to the deceased’s spouse, and the rest will be divided according to a set of rules. It should be noted that regarding Spain, there are additional inheritance rules that vary between its autonomous communities. In most European countries, there are restrictions on how inheritance is distributed (France, Germany, Italy, etc.).

As mentioned, currently there is no inheritance or estate tax in Israel, but such a tax may well be imposed in the coming years. This is because, in a comparative view, most OECD countries impose an inheritance tax, as well as the state’s aspiration to reduce its deficit.

Why is Tax Planning Important Before Realizing Inheritance from Abroad?

Realizing inheritance from abroad without prior tax planning may lead to unnecessary tax liabilities worth hundreds of thousands of shekels. Early tax planning allows identification of tax policies in different countries and utilization of tax benefits and prevention of double taxation.

Realizing Inheritance from Abroad – What is Recommended to Check?

Realizing inheritance is a complex process that includes many challenges and risks. There are several issues to consider before starting the process.

- Banking Engagement Aspects– It is recommended to check the costs of money transfers, examine whether there is a need to open an account abroad to transfer funds, KYC (know your client) approvals, and more.

- Timing of Inheritance Realization– One should examine when it is advantageous to realize the inheritance and in what order it is most beneficial to realize the estate’s assets. Sometimes these decisions will have a decisive impact on offsetting losses or on which authority will collect the tax.

- Location of Asset Realization– In certain cases, choosing to realize assets in a specific location may be more advantageous in terms of taxation. One should examine the alternative of realizing assets in the deceased’s country of death versus realizing them in the heir’s country of residence. When it comes to real estate, of course, the question is not relevant, but for assets such as stocks or various securities, sometimes there is a choice.

For example, one way is to sell the securities in the country of origin, and another option is to transfer the securities through the stock exchange clearing house to an account in Israel, and only then sell the securities. Each course of action can have a different tax outcome. Such a situation will, of course, require a chain of procedures that will legally enable the realization and prevent actions by authorities that could harm the realization of the inheritance.

The Importance of Tax Planning

There is great importance to optimal tax planning to avoid high taxation on the entire value of the inherited asset.

The goal in tax planning is to transfer the inheritance to heirs in Israel in the most tax-advantageous way, while addressing tax, legal, banking, and regulatory issues in Israel and abroad.

Here we will numerically demonstrate how the absence of tax planning can manifest –

An asset abroad that was worth $900,000 at the time of the deceased’s death was sold after several years for $1,000,000. In this situation, the taxpayer can and should pay tax on a profit of only $100,000. Without optimal tax planning, the tax that the taxpayer will have to pay will be based on a profit of $1,000,000 (!). Hence, the importance of optimal tax planning is clear. This part of tax planning is called STEP-UP, and to achieve it, the representative needs to approach the Professional Division of the Tax Authority Management to obtain a preliminary tax approval.

For further reading on this process, click here.

Our firm has extensive experience in accompanying inheritance/estate realization processes in many countries. As a result, our firm is knowledgeable and proficient in the unique procedures for realizing inheritance in different countries and the ways to work with various authorities on this matter.

For personal consultation on this matter, contact us.

Q&A

Is there an inheritance tax in Israel?

There is no tax in Israel. But in the case of selling an asset received through inheritance – tax will be imposed according to the provisions of the law.

Is there an estate tax in Israel?

No. There was an estate tax in Israel, but it was abolished in 1981.

What is the difference between the estate tax and the inheritance tax?

Estate tax is imposed on the entire estate before distribution.

Inheritance tax is imposed on each heir after receiving their share.

How can one save on tax when receiving an inheritance from abroad?

By building a strategy according to the tax policy abroad and in Israel and planning the realization of the inheritance in advance – that is, choosing the timing of realization and the place of realization.

What is the STEP-UP procedure and how can it help me?

Essentially, receiving an asset through inheritance or as a gift does not constitute a tax event, but when an Israeli resident comes to sell it, they will have to pay capital gains tax. The core of the issue is how the tax payment in Israel will be calculated for the sale and how the tax payment can be significantly reduced.

According to the STEP-UP mechanism in Israel, in certain cases, an Israeli resident who received an inherited asset from outside Israel – the basis for calculating capital gain takes into account the time of death instead of the original price date.

For more on this topic, read the article “Step Up – Tax Exemption on Assets Received in Inheritance from Abroad.“

Do I need to report foreign inheritance to the Israeli Tax Authority?

There is no requirement to report an inheritance received from abroad, provided that the inheritance does not generate any income.

What happens if the deceased was a resident of a country that has an inheritance tax?

One must examine whether they need to pay the tax in that country, which depends on the country’s tax treaty, the asset, and the deceased’s will.

Is it advisable to open a bank account in the country of origin to receive the inheritance?

Not necessarily. Each case must be examined individually, considering all regulatory aspects, costs, and tax implications. There may be cases where it is preferable to transfer the inheritance directly to Israel.