UTC:

Capital City:

Language:

Population:

Currency:

Country Code:

Domain:

+1

Prague

Czech

10.7 million

Czech koruna

+420

cz

Recent news

Czech Republic-Israel Relations

The relations between the Czech Republic and Israel are strong and friendly. Politicians in the Czech consistently support Israel in times of strong international pressure. Former Czechoslovakia was among the first nations to recognize the independent state of Israel in 1948. Czechoslovakia was also one of the first and only nations willing to sell arms to the newly formed state of Israel. There is a Czech Republic embassy in Tel Aviv and there is an Israel embassy in Prague, Czech.

Details about Embassy of the Czech Republica’s in Israel

Bank Discount Tower, Level 28, 23 Yehuda Halevi St, Tel Aviv 6513601

+972 3 6935000

telaviv.embassy@dfat.gov.au

Website: Click Here

Details about Israel’s embassy in the Czech Republic

Badeniho 2, 170 06 Praha 7, Czech Republic

(+420) 233 097 500

embassies.gov.il/praha

info@prague.mfa.gov.il

Bilateral Agreements

- Convention between the Czech Republic and the State of Israel for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income (1993) LINK

- Agreement between the Government of the Czech Republic and the Government of the State of Israel on the Waiver of the Visa Requirement for the Holders of Diplomatic and Service Passports (1995). LINK

- Agreement between the Government of the Czech Republic and the Government of the State of Israel on Social Affairs (2003). LINK

Czech Republic-Israel Double Tax Treaty

The double tax treaty for Czech and Israel established in 1993 to eliminate double taxation with respect to taxes on income as well as the prevention of tax evasion and avoidance. Israel and the Czech Republic work in the effort of their joint citizens to create the best economic solution for both nations. The full English taxation treaty can be found here.

Residency for Tax Purposes

If an individual stays in the Czech Republic for more than 183 days in a one-year period, then they are required by law to pay taxes. Or if an individual has a permanent residence where the individual intends to live in permanently. Also, just owning a long-term visa does not automatically make an individual a tax resident.

To learn about how an individual is considered a resident of Israel read here.

A company is considered a resident in the Czech Republic for tax purposes if it has its registered seat or its place of management located directly in the Czech Republic.

To learn about how a company is considered a resident of Israel read here.

Czech Tax Regime

Czech Republic’s tax system was recently developed in 1993 and divides taxes into 3 groups. Those groups being direct taxes, indirect taxes, and other taxes. Due to the EU accession on May 1, 2004, Czech Republic’s tax system went through some revitalizations alongside the European legislations.

Individual Income Tax: 15% or 23%

Corporate Tax: 21%.

VAT:

- Standard: 21%

- Reduced 10-15%

- Certain goods and services such as groceries, construction work related to social housing is reduced to 15%

- Specified goods such as books, newspapers, supplies of heat/cold are reduced to 10%

Capital Gains Tax: There is no separate capital gains tax, they are included in CIT base and taxed as ordinary income in the taxable year.

Withholding Tax

| Czech Internal tax rate | Israel Internal tax rate | Treaty Withholding Tax |

Personal Income tax (Tax brackets) | 15% | 0%-50% For more | – |

Corporate income tax | 19% | 23% | – |

Individual capital gains tax rate | Subject to normal CIT rate | 25%-30% (plus exceptional income tax for high earners at 3%) | – |

Branch tax | No specific branch tax | 23% | – |

Withholding tax (Non-Resident) Dividends |

15%

|

25% or 30%

|

5%/15% |

Interest

| 0

| 15%/25%/23% | 0%/10% |

Royalties | 0 | 23%-40% | 5% |

VAT | 21% | 18% | – |

Inheritance tax | NA | NA | – |

Therefore, according to the treaty, the rate of withholding tax for dividends in Czech Republic is 5%/15%, Interest of 0%/10%, Royalties of 5%.

Inheritance & Estate Tax

Since 2014, there has been no estate or inheritance tax in the Czech Republic. However, after the beneficiary decides to sell parts of the estate, the sale will be subject to personal income tax. Therefore, it is encouraged that property be gifted while the deceased is still alive so that there is no tax placed on it. In Israel, there are no inheritance or estate taxes.

Currency differences between Czech-Republic and Israel

The Czech Republic currency is called the Czech koruna or Czech crown. The currency symbol is CZK. The Israeli currency called New Israel Shekel (NIS) or Israeli Shekel (ILS).

Transfer Pricing in Czech Republic

Czech Republic transfer pricing legislation contains a general definition of the arm’s-length principle which reflects the principle in the OECD guidelines. The legislation covers transactions between companies and individuals and applies to domestic transactions as well as cross-border ones. For more information about transfer pricing in Czech Republic click here.

Transfer Pricing in Israel

The legislation within Israel in respect of transfer pricing is disclosed within Section 85A of the Israel Tax Ordinance (New Version), 1961 and the Income Tax Regulations (Determining Market Conditions) – 2006 (The Regulations). Click here for more information on Israel transfer pricing.

MLI Applicability

Czech Republic and Israel both signed the MLI, meaning that there is an automatic exchange of information between the two countries. Israel signed the MLI on 06/07/2017 and it was entered into force on 01/01/2019. Czech Republic signed the MLI on the same date as Israel on, 06/07/2017 but it did not go into effect until 09/01/2020. The Czech tax authorities regularly reports on the bank accounts and assets held by Israelis in Czech Republic and Israel Tax authority reports on bank accounts of Czechs in Israeli banks. In recent years, the Israeli tax authority began to use the information in a criminal investigation of taxpayers within Czech Republics’ bank accounts. No income earned in the foreign account was disclosed.

Relocation

Czech Republic remains to be a fairly stable economy with a population standing at 10.7 million. It is projected to continue to rise till its peak in 2026 then begin declining. The Republic has a well-developed macroeconomic policy which allows for stability. Czech Republic is home to many foreigners due to its accepting environments.

Real Estate

Since the accession to the EU and adoption of the last amendment of the Foreign Exchange Act, it has become more accessible for international individuals to buy property in the Czech Republic. For citizens of Czech, legal entities located in Czech, foreigners with a permanent residence permit or those who are granted asylum in Czech there are no restrictions when buying property. As for citizens outside of the EU or the US, it becomes more complicated to buy property as it comes with more regulations and restrictions.

Business Activities between the Czech Republic and Israel

Our firm specializes in providing tax advice and assistance to our clients in Czech Republic. Our numerous relationships with accountants and lawyers in Czech Republic help aid clients by setting up businesses, opening bank accounts, and connecting Czech Republics to Israeli companies. Specific information on real estate investments in Czech Republic can be found on our Overseas Real Estate Investment page.

As part of the joint economic activity between the two countries, the Israel-Czech Chamber of Commerce and Industry was established in 2010. The Chamber of Commerce plays an important role in promoting and assisting the economic and commercial cooperations between the countries. The Chamber of Commerce helps Israeli and Czech businessmen and companies that are interested in expanding their activity in these countries. The Chamber of Commerce assists in finding contact, overcoming cultural differences and more. The management and board of directors consists of influential figures from the business sectors of both countries. Among them is Nimrod Yaron, the managing partner of our firm, who also serves as a director within the Chamber of Commerce.

Transfer of Funds

Transfer of funds from Israel to Czech Republic

According to section 170(a) of the Israeli income tax ordinance, any transfer of payment to a non-Israeli resident is subject to 25% of withholding tax. The tax authority can allow, under certain circumstances, to reduces or dismiss the withholding tax. Our firm handles withholding tax matters with the Israeli Tax Authority.

Due to the fact that both countries have a tax treaty with each other, one can submit a declaration form (2513/2 form – Statement regarding a payment to a foreign resident that is exempt from withholding tax), and under certain circumstances, there is a possibility to transfer the payment without the withholding tax and the approval of the Tax Authority.

In providing advice regarding the transfer of money abroad, in addition to the issue of withholding tax, our office handles the requirements of the foreign banks, such as an accountant’s approval regarding the payment of taxes and examines additional actions required in light of the uniform standard of CRS between the countries – automatic exchange of information between countries which is carried out first through the banks and then between the tax authorities of each two countries.

The banks raise many difficulties and charge high fees for converting shekels into other currencies, so it is important to consult before transferring the funds – Contact us.

For more information on money transfers abroad, click here.

Transfer of funds from Czech Republic to Israel

Our firm helps to transfer money from Czech Republic to Israel in the easiest and cheapest way.

Types of business entities in Israel

- Company

- Private

- 1-50 shareholders

- Can’t sell stocks or debentures

- Public

- Minimum of 7 shareholders

- Must publish an annual report

- Can sell stocks or debentures

- Foreign Company

- A company from overseas with a branch in Israel

- Partnership

- Self- Employed

- Cooperative

- Non-Profit Organizations

- Private

Types of business in entities in Czech Republic

- General Partnership

- A type of business agreement made by at least two individuals where all assets or profits are shared amongst each other

- Limited Partnership

- An entity where a partner is responsible for obligations of the company up to the amount of the unpaid parts of the contributions made to the Commercial Register

- Limited Liability Company

- This form of business entity is the most commonly used in Czech Republic

- Registered capital is made up of contributions paid by shareholders

- Those specific shareholders are responsible for the unpaid parts of the contributions to the Commercial Register

- Joint Stock Company

- In a joint stock entity, the contributions are divided into shares, and each has a nominal value.

- The specific shareholders not responsible for the company’s obligations

- The Board of Directors is responsible for managing the company’s business activities and act as the statutory body of the company.

Social Security Tax in Czech Republic

Social security taxes are obligatory for employees to receive. The contributions are determined by an individual’s gross remuneration. The rates for the employer are 24.8% and contribution rates for the employee are 6.5% and the payments are done by the employer for both employee and employer parts of the contributions.

For information about Israel’s social security tax click here.

Incentive Laws in Czech Republic

Investment incentives are only for Czech entities and Czech subsidiaries of foreign companies. Incentives given can include cash support for new jobs/training, capital expenditures and more. 25% from eligible costs is the maximum amount of support from incentives that can be given.

For information about Israel’s incentive laws click here.

Czech Republic Tax Authority

The Ministry of Finance of the Czech Republic and its subordinated tax authorities administer and collect individual taxes. Subordinated tax authorities in Czech Republic can include the Appellate Financial Directorate, the Specialized Tax Office, Tax Offices, and the Territorial Branches. For more information click here and here21

At the Czech Embassy after a lecture by our office to the delegation led by the Speaker of the Czech Parliament

- Specific information on real estate investments in the Czech Republic can be found on Nadlan-Global website.

- CPA Nimrod Yaron was interviewed in the most widely spread daily newspaper in the Czech Republic, on the subject of an investment port – an opportunity for exporters.

- In December 2023, Nimrod was interviewed by the well-respected Czech newspaper “Hayom”. To read the article, click here.

Czech Republic Double Tax Treaties

Albania | Brazil | Ethiopia | Indonesia | Lebanon | Morocco | Poland | South Korea | Turkmenistan |

Armenia | Bulgaria | Finland | Iran | Liechtenstein | Netherlands | Portugal | Spain | Ukraine |

Australia | Canada | France | Ireland | Lithuania | New Zealand | Romania | Sri Lanka | United Arab Emirates |

Austria | Chile | Georgia | Israel | Luxembourg | Nigeria | Russia | Sweden | United Kingdom |

Azerbaijan | China | Germany | Italy | Malaysia | North Korea | Saudi Arabia | Switzerland | USA |

Bahrain | Colombia | Greece | Japan | Malta | Macedonia | Serbia | Syria | Uzbekistan |

Barbados | Croatia | Hong Kong | Jordan | Mexico | Norway | Singapore | Tajikistan | Venezuela |

Belarus | Cyprus | Hungary | Kosovo | Moldova | Pakistan | Slovakia | Thailand | Vietnam |

Belgium | Denmark | Iceland | Kuwait | Mongolia | Panama | Slovenia | Kazakhstan | |

Bosnia & Herzegovina | Estonia | India | Latvia | Montenegro | Philippines | South Africa | Turkey |

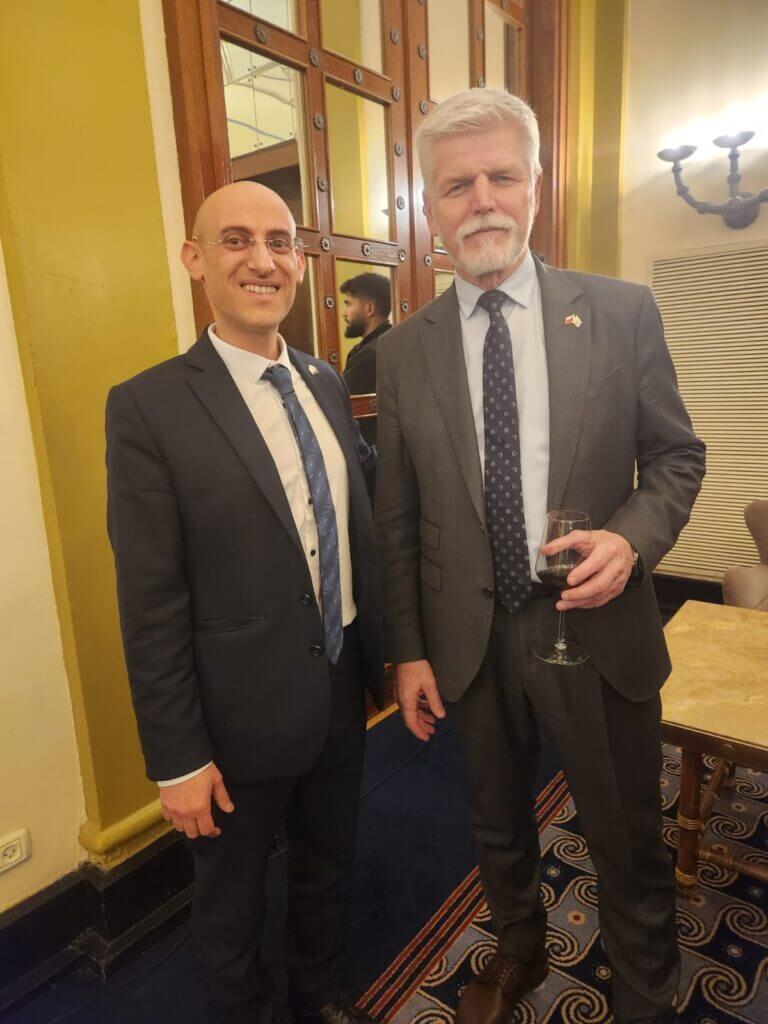

On January 14, 2024, Nimrod Yaron was invited to meet the President of the Czech Republic, Mr. Petr Pavel, during his solidarity visit to Israel.

List of the largest banks in the Czech Republic by number of clients:

- Česká spořitelna – Click Here

- ČSOB –Click Here

- Komerční banka – Click Here

- Moneta Money Bank – Click Here

- Raiffeisenbank – Click Here

- Fio banka – Click Here

- Air Bank – Click Here

- mBank – Click Here

- UniCredit Bank – Click Here

- Hello Bank – Click Here

List of the largest banks in the Czech Republic by profit:

- Česká spořitelna

- ČSOB

- Komerční banka

- UniCredit Bank

- Moneta Money Bank

- Raiffeisenbank

- Air Bank

- Fio banka

- Banka Creditas

- Hello Bank