UTC:

Capital City:

Language:

Population:

Currency:

Country Code:

Domain:

+3

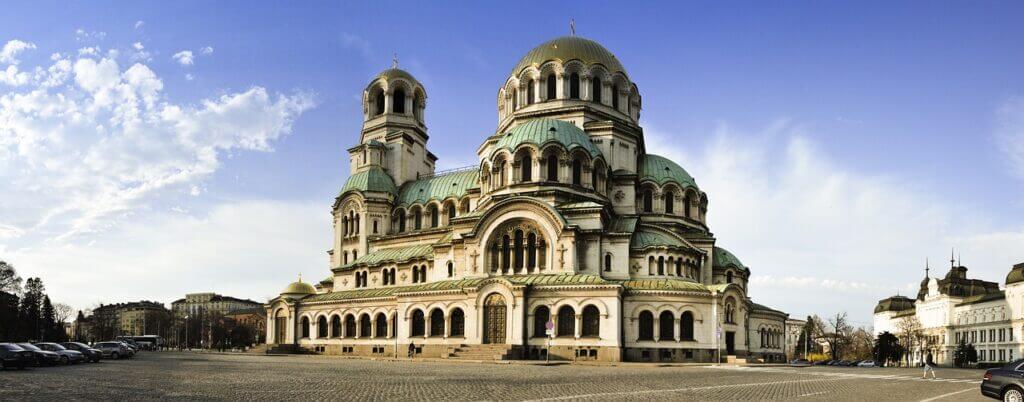

Sofia

Bulgarian

6.61M

Bulgarian lev

+359

.bg

Recent news

Israel – Bulgaria relations

Israel and Bulgaria have maintained relations since 1948. Both countries have entered into significant Bilateral Agreements, highlighting the positive diplomatic and friendly relationship between the two nations. For example, in 1995 Bulgaria and Israel signed the Agreement for Scientific Cooperation. This strong connection encourages collaboration on global challenges, cultural exchanges, and commercial collaborations, therefore strengthening their strategic bond.

Details about Israel’s embassy in Bulgaria

Address: Geo Milev, Boulevard “Shipchenski Prohod” 18, 1113 Sofia, Bulgaria

Phone: +359 2 903 35 00

Website: Click Here

Email: info@sofia.mfa.gov.il

Details about Bulgaria Embassy in Israel

Address: Sderot Sha’ul HaMelech 8, 9 floor, Tel Aviv-Yafo, Israel

Phone: +972 3-696-1361

Website: Click Here

E-mail: Embassy.TelAviv@mfa.bg

Business Activity in Bulgaria

Bulgaria’s economy has been steadily growing, thanks to its European membership and commitment to economic reform, which has improved the business climate and attracted foreign investment. The country offers a straightforward regulatory environment, simplifying the process of starting a business. Foreign investors benefit from various government incentives, especially in technology, manufacturing and energy, including tax reductions and financial support.

Bulgaria’s strategic location at the crossroads of Europe and Asia, combined with a skilled workforce in sectors such as IT and engineering, makes it an appealing business destination. Furthermore, European membership provides access to the European market and numerous funding opportunities, making it even more desirable for business operations.

Bilateral Agreements Between Bulgaria and Israel

Israel and Bulgaria have signed the following agreements:

- International Investment Agreement

- Double Taxation Agreement

Reciprocal Promotion and Protection of Investments

The Agreement on Promotion and Protection of Investment between Israel and Bulgaria, signed on December 6, 1993, went into effect on December 17, 1996, and aims to establish favorable conditions for investments in both countries. This bilateral agreement is designed to foster a supportive and secure environment for investors, promoting economic cooperation and development between Israel and Bulgaria.

To read the agreement in English, click here.

Convention on the Prevention of Double Taxation

The agreement between the Governments of Israel and Bulgaria regarding the avoidance of double taxation was signed on January 18, 2000, and entered into force on January 1, 2003.

To read the agreement in English click here.

Applicability of the MLI

The Multilateral Instrument (MLI) applies to the tax treaty between Israel and Bulgaria, focusing on preventing tax evasion and avoiding double taxation. Both Israel and Bulgaria have signed the MLI on June 7, 2017. The MLI went into force on January 1, 2023, and in Israel on January 1, 2019.

Residency for Tax Purposes in Bulgaria

Residence of an Individual

Individuals are considered tax residents in Bulgaria if:

- They maintain a permanent address in the country;

- They reside in Bulgaria for more than 183 days in any 12-month period;

- They work abroad for the Bulgarian government or enterprises, or have their center of vital interest in Bulgaria.

To read about how an individual is considered a resident of Israel, click here.

Residency of a Company

For tax purposes a company is considered a resident if it is incorporated in Bulgaria.

To learn about how a company is considered a resident of Israel, click here.

The Tax System in Bulgaria

The Bulgarian Tax Authority is called the National Revenue Agency.

Income taxation: 10%

Taxation of companies and branches: 10%

VAT: 20%

Capital gains tax: 10%

Withholding Tax

| Bulgaria Internal Tax Rate | Israel Internal Tax Rate | Treaty Withholding Tax |

Personal Income tax (Tax brackets) | 10% | Up to 50% | |

Corporate income tax | 10% | 23% | |

Capital gains tax rate | 10% | 25%-30% (plus 3% surtax for high earners) | |

Branch tax | 10% | 23% | |

Withholding tax (Non-Resident) Dividends | 5% | 25% or 30% | 7.5%, 10%, 12.5% |

Interest

| 10% | 15%/25%/23% | 0%, 5%, 10% |

Royalties | 10% | 23%-40% | 7.5 to 12.5% |

VAT | 9 % to 20% | 18% |

Inheritance Tax and Estate Tax in Bulgaria

Inheritance tax applies to the estate of a deceased Bulgarian citizen, regardless of whether the property is in Bulgaria or abroad, when inherited by legal or testamentary succession. It also applies to property located in Bulgaria inherited from a deceased foreign citizen. The estate includes all movable and immovable property, property rights, receivables, and liabilities that belonged to the deceased at the time of inheritance.

Tax rates for siblings and their children are 0.4% to 0.8% for inheritance exceeding BGN 250,000, while for others, it is 3.3% to 6.6% for the same amount. The tax is administered by municipal officers according to the Tax and Social Insurance Procedure Code.

When the property is donated or acquired for free, tax is imposed on the assessed value of the transferred property at rates set by the Municipal Council that range from 0.4% to 0.8% for donations between siblings and their children and from 3.3% to 6.6% between other individuals.

Tax exemptions include properties acquired by the state, municipalities, educational and cultural organizations, the Bulgarian Red Cross, and non-profits. Donations for medical treatment, humanitarian aid, and religious institutions are also exempt.

Relocation to Bulgaria

Living and starting a business in Bulgaria has many benefits. Those include its strategic location, providing easy access to the Middle East and the Balkans, the low cost of living, and a well-educated workforce.

Furthermore, the corporate tax rate is just 10%, one of the lowest in the European Union. In Addition, Bulgaria’s EU membership facilitates the free movement of people, goods, and services, within the region, making it attractive for startups. Moreover, the cost of doing business in the country is relatively low.

Bulgaria’s Jewish community, which numbers between 2,000 and 6,000, has witnessed tremendous growth and resurgence of communal knowledge in recent years.

Real Estate Taxation in Bulgaria

Bulgaria imposes a property tax to land, buildings, and parts of buildings situated within the country. For residential and commercial properties owned by individuals, the taxable amount is based on the assessed value of the property.

For residential properties owned by businesses, the taxable amount is calculated similarly. For non-residential properties owned by businesses, the taxable amount is determined as whichever is greater: their book value or the tax-assessed value.

The tax rate for property is set by the Municipal Council through an ordinance, ranging from 0.1% to 4.5% of the property’s assessed value.

Transfer of Funds from Israel to Bulgaria

According to section 170(a) of the Israeli Income Tax Ordinance, all payments transferred to non-Israeli residents are subject to a 25% withholding tax. However, this tax can be reduced or even waived if certain conditions are met.

As mentioned above, the countries have signed a tax treaty, that allows taxpayers to submit 2513/2 form – Statement regarding a payment to a foreign resident that is exempt from withholding tax, to potentially transfer the payments without paying the withholding tax.

In addition to assisting with withholding tax matters, our firm also helps with other issues related to transferring funds abroad. This includes providing an accountant’s approval regarding the payment of taxes, reviewing additional actions required under the CRS standard, and more.

Moreover, banks often raise many difficulties and charge high fees for converting shekels into other currencies. Therefore, consulting with a specialist before transferring the funds is highly recommended, click here to contact us.

For more information on money transfers abroad, click here.

Types of Business Entities in Bulgaria

The most common types of business in Bulgaria are:

Sole Proprietorship – This type of business is owned and administrated by an individual and is not considered as a separate legal entity from the owner. The owner is personally liable for all business debts and obligations towards the state or third parties.

Limited Liability Company – This type is the most used for small to medium-sized businesses. It may be established by one or more persons. The liability of the shareholders is limited to the amount of their contributions to the company’s capital. For the establishment of a limited liability company, a minimum capital of 2 BGN (about 1 EUR) is required.

Joint Stock Company – A Joint Stock Company is ideal for larger businesses and allows for public offering of stocks. It requires at least three founders and a minimum capital of 50,000 BGN (approximately 25,000 EUR). Shareholders are liable only up to the amount they invest in the company’s stocks.

Incentive Laws in Bulgaria

In Bulgaria, the legal and regulatory framework is designed to create a favorable and equitable business climate for both local and foreign investors. In Bulgaria, the legal framework is designed to create a fair and inviting atmosphere for both domestic and international businesses. The Bulgarian Constitution and the 2004 Investment Promotion Act (IPA) ensure that local and foreign businesses are treated equally in economic matters.

Foreign investors in Bulgaria can establish companies and enjoy the same rights as national investors. Qualifying investment projects can apply for a “Certificate for Investment Project” from the Ministry of Economy, which offers benefits like reimbursement of social and health insurance contributions, expedited administrative services, and financial support for technical and professional development.

Tax incentives in Bulgaria also include:

- Partial corporate income tax reductions for agricultural activities.

- Additional tax deductions for hiring long-term unemployed, handicapped, or elderly persons.

- Up to 100% CIT reimbursement for investments in high-unemployment regions.

These laws and regulations demonstrate Bulgaria’s commitment to fostering a business-friendly environment, encouraging investment, and ensuring fairness and transparency in the treatment of investors.

Double Tax Treaties: Bulgaria

Albania | Denmark | Israel | Mongolia | Singapore | United Arab Emirates |

Algeria | Egypt | Italy | Montenegro | Slovak Republic | United Kingdom |

Armenia | Estonia | Japan | Morocco | Slovenia | United States |

Austria | Finland | Jordan | North Korea (D.P.R.K.) | South Africa | Uzbekistan |

Azerbaijan | France | Kazakhstan | Norway | South Korea | Vietnam |

Bahrain | Georgia | Kuwait | Pakistan | Spain | Zimbabwe |

Belarus | Germany | Latvia | Poland | Sweden | |

Belgium | Greece | Lebanon | Portugal | Switzerland | |

Canada | Hungary | Lithuania | Qatar | Syria | |

China | India | Luxembourg | Romania | Thailand | |

Croatia | Indonesia | Macedonia | Russian Federation | The Netherlands | |

Cyprus | Iran | Malta | Saudi Arabia | Turkey | |

Czech Republic | Ireland | Moldova | Serbia | Ukraine |