U.S. Tax Returns

Filed with the Internal Revenue Service, IRS or a state/local tax agency, a tax return is a crucial element to the governmental structure of the United States. Through property calculations, a tax return is how governments know how much money each person is required to pay their government. As understood in “United States Taxation” (link to that article), taxes cannot be linked to a specific benefit but it’s a general payment to your government for all their services.

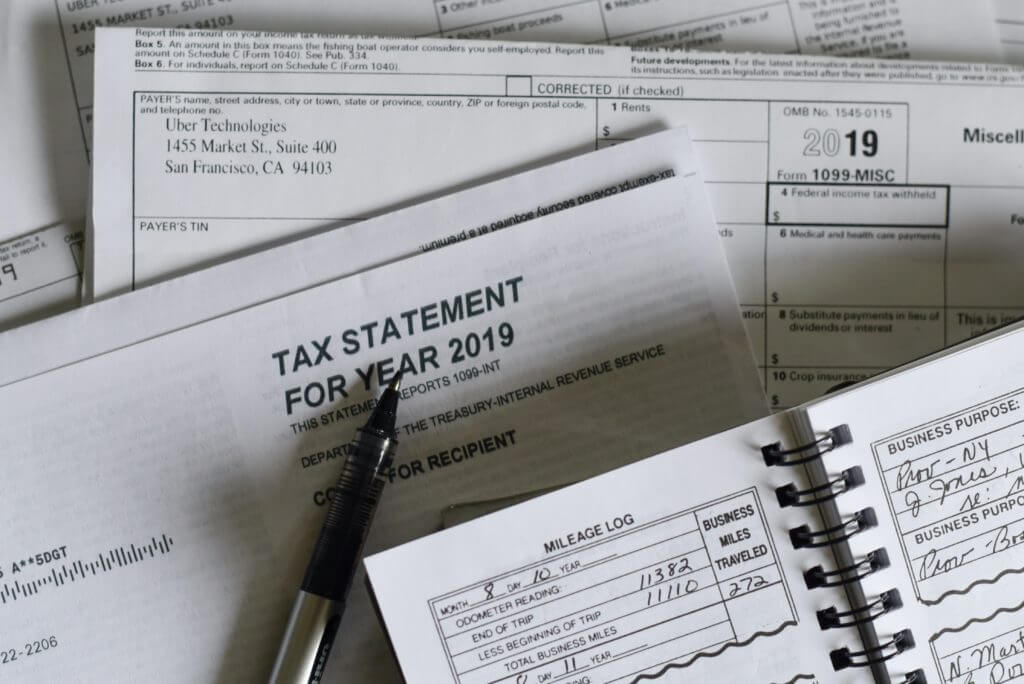

The tax return is a moderately complicated process in which individual citizens are required to calculate their taxes owed, their tax liability. Often times people enlist the help of tax professionals and computer software to help assist them with their calculations. Failure to properly calculate your tax liability can result in heavy fines and punishments assessed by the government. Understanding a brief overview of the federal government’s tax return will allow you to see how taxes affect all individuals and business.

The IRS is responsible for collecting ensuring correct tax returns for all corporations and individuals in the United States. In 2019, they collected over $3.5 trillion dollars.

The Federal Tax Return

Firstly, the due date of your tax return. A standard tax return has an April 15th deadline, with more complicated returns being allowed on October 15th of the year following the tax year you are calculating. For example, your due date for the year 2000 was due on April 15th or October 15th, 2001, respectively.

Calculating Taxable Income

As an individual, you fill out various forms provided by the IRS to indicate different financial information. Most commonly, the Form 1040 is where the Individual calculates the total taxable income and thus how much is owed to the federal government. In practice, a federal return has significantly more complications and variables than just a 1040 alone, but the 1040 is essential in the foundation of any return.

There are various other forms for different types of organizations. For C corporations, they file a Form 1120 to calculate their taxable income.

Tax Liability

After calculating the taxable income, you will be determined how much is owed to the federal government in taxes using the tax brackets which were determined by the United State Congress, these change frequently along with the overall tax code. You can read more about calculating your tax liability, “United States Taxation” (link to that article).

Paying your Taxes

Once you have determined your tax liability, you can pay the IRS by simply writing a check to the IRS, it is important to calculate the amount of taxes withheld by the federal government in anticipation of your inevitable taxes. Conversely, the IRS can sometimes withhold more money than you owe in taxes, in that case you will get a refund from the IRS in the form of a check or direct deposit.