Profit Split Method

When conducting a transfer pricing study, one must select the most appropriate comparison method to show that the prices set in a controlled transaction (i.e.,

NY » Transfer Pricing » Page 2

When conducting a transfer pricing study, one must select the most appropriate comparison method to show that the prices set in a controlled transaction (i.e.,

When conducting a transfer pricing study, one must select the most appropriate comparison method to show that the prices set in a controlled transaction (i.e.,

When conducting a transfer pricing study, one must select the most appropriate comparison method to show that the prices set in a controlled transaction (i.e.,

Introduction to Advance Pricing Agreements – Transfer Pricing In the current business world, taxpayers seek assurance and confidence in handling their taxes and minimizing risks.

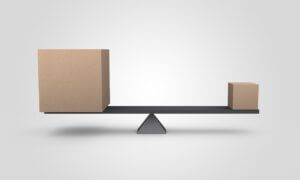

Maintaining the Arm’s Length Principle The arm’s length principle is rooted in a solid theoretical foundation as it closely mirrors the dynamics of the open

Introduction to Arm’s Length Principle The internationally recognized Arm’s Length Principle forms the basis of transfer pricing. It states that when related parties engage in

Methodology and Approaches of Transfer Pricing Studies Section 85A to the Income Tax ordinance, states that an international transaction between related parties (controlled transaction) should