Time Value of Money

The time value of money, or TVM is a concept within the financial arena that focuses on the concept behind the changing value of currency in the future. Specifically, the same quantity of money you have now has greater value now than it will in the future. This principle can be unpacked deeper to understand the concept further.

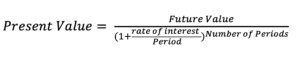

The present discounted value is another name for TVM, and the concept is centered around investments primarily. Using the concept of TVM, it would be correct to choose to receive money from an investment as soon as possible rather than in the future for a few reasons; opportunity costs of not investing, compound interest, and inflation. The formula for computing TVM incorporates variables such as the current payment, the future value of the dollar, the interest rate, and the time frame including compounding period.

The exact formula is:

We can use this formula with a literal example that will help illustrate the concept. For example, would you rather the following options

A: $10,000 today

B: $10,000 in 6 months

While there is an equal amount of money being distributed, the opportunity cost on taking option B is that you cannot invest the 1000 now, thus missing out on the massive effects of compounding interest.

See the difference with 5% semiannual interest over the next 10 years between options A and B

The Present Value formula can be reorganized to calculate the future value of a current investment or a current investments future value.

A: Future Value after 10 years: $36,165

B: Future Value after 10 years: $33,799

Over $2300 in difference by receiving the same amount of money just six months later!

In relation to employee stock options and deferred compensation, taking the present value factors into account is essential for seeing the total present and future value of these financial packages and making an educated decision.